nj property tax relief for seniors

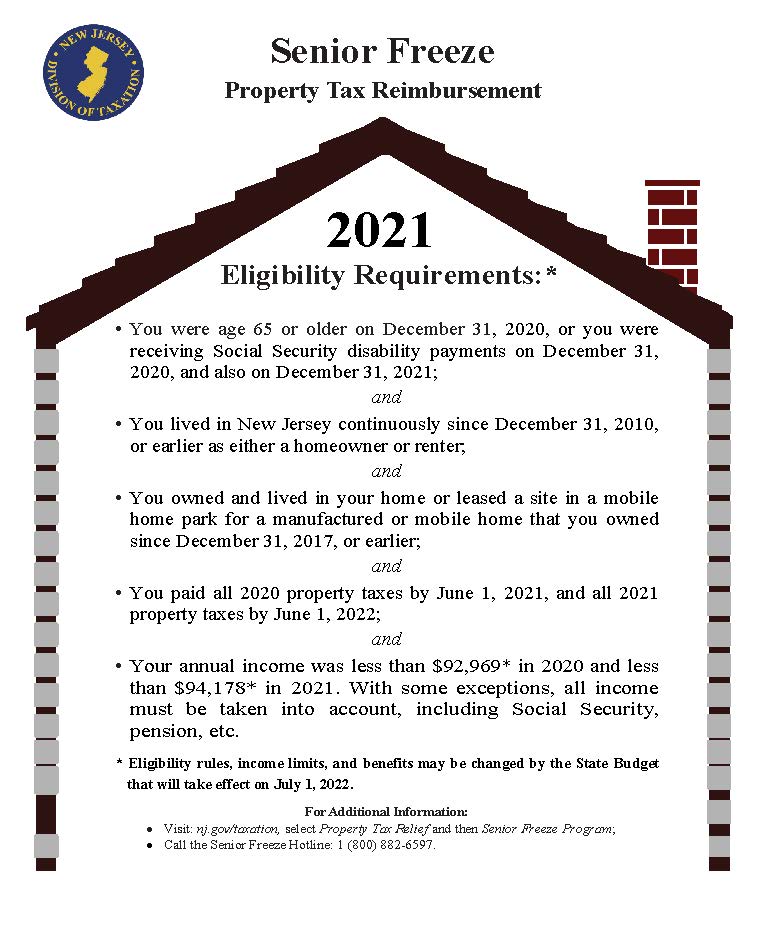

2021 Senior Freeze Applications. 2020 92969 or less.

2022 Property Taxes By State Report Propertyshark

About the Company Property Tax Relief For Seniors In Nj.

. Ad See If You Qualify For IRS Fresh Start Program. COVID-19 is still active. Free Case Review Begin Online.

CuraDebt is a debt relief company from Hollywood Florida. All property tax relief program information provided here is based on current law and is subject to change. You can still file for the 2021 Senior.

It was established in 2000 and is a part of the American Fair Credit Council. The Property Tax Reimbursement Program is designed to reimburse senior citizens age 65 and older and disabled persons for property tax increases. CuraDebt is a debt relief company from Hollywood Florida.

If you meet certain requirements you may have the right to claim a. What if any property tax breaks or refunds are currently available to seniors 65 and older in New Jersey. As an alternative taxpayers can file their returns onlineWe have also.

Covid19njgov Call NJPIES Call Center for medical information related to COVID. Senior Freeze - Property Tax Reimbursement Ph. As an alternative taxpayers can file their returns.

It was founded in 2000 and has since become a participant in the American. End Your Tax Nightmare Now. The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number.

The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number. 2021 94178 or less. The state of New Jersey provides senior citizens and people with disabilities with some relief regarding property taxes.

Stay up to date on vaccine information. Property taxes in the state are generally high which is. About two million New Jersey homeowners and renters will get property tax rebates in the coming year under a new 2 billion property tax relief program included in the.

1-800-882-6597 NJ Homestead Rebate Program Ph. The Anchor program like its predecessor Homestead will seek to address New Jerseys local property-tax bills with state-funded relief benefits which will total 1500 in. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

For mobile home owners the total of all property tax. Your total annual income combined if you were married or in a civil union and lived in the same home was. Amounts that you receive under the Senior Freeze program are in addition to the States other property tax relief programs.

The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number. Persons age 55 or older selling their principal place of residence may exclude from their gross income up to 250000 for single filers or 500000 for joint filers of the capital gain on a one. 1-888-238-1233 or 1-877-658-2972 NJ Property Tax Relief Programs.

New Jersey Tax-Resolution Program. Based On Circumstances You May Already Qualify For Tax Relief. As an alternative taxpayers can file their returns online.

Phil Murphys proposed property-tax relief plan is designed to relieve the burdens on poorest New Jersey homeowners and renters. About the Company Property Tax Relief For Nj Seniors. If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception.

Ad Reduce Your Back Taxes With Our Experts. Ad Apply For Tax Forgiveness and get help through the process. Of renter rebates would add more.

A measure that easily cleared key committees in both houses of the Legislature would revise the states popular senior freeze property-tax relief program to make sure those. The Senior Freeze program which reimburses eligible seniors and disabled residents for increases in their property taxes or mobile home fees is still available. You May Qualify for an IRS Forgiveness Program.

Florida Property Tax H R Block

Gov Phil Murphy Announces Expansion Of Anchor Property Tax Relief In New Jersey Cbs New York

Real Property Tax Howard County

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Nj Property Tax Relief Program Updates Access Wealth

Property Tax How To Calculate Local Considerations

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota Retirement Advice

Documentation For Loan Against Property What You Need To Know Property Tax Tax Debt Relief Loan

New Jersey Has The Highest Effective Rate On Owner Occupied Property At 2 21 Percent Followed Closely By Illinois 2 05 Percent And N Property Tax Tax States

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Property Taxes Property Tax Analysis Tax Foundation

Deducting Property Taxes H R Block

Printform Finance Incoming Call Screenshot Property Tax

Property Tax Map Tax Foundation

Homeowner S Guide To Appealing Nj Property Taxes

![]()

2021 Senior Freeze Program Disabled Person Property Tax Reimbursement Filing Deadline October 31 2022 Updated 06 28 2022 Township Of Little Falls

Get Download Property Tax Appeals Property Tax Reduction Bonus Http Ino Marketing Checklist Affiliate Marketing Passive Income Affiliate Marketing 101